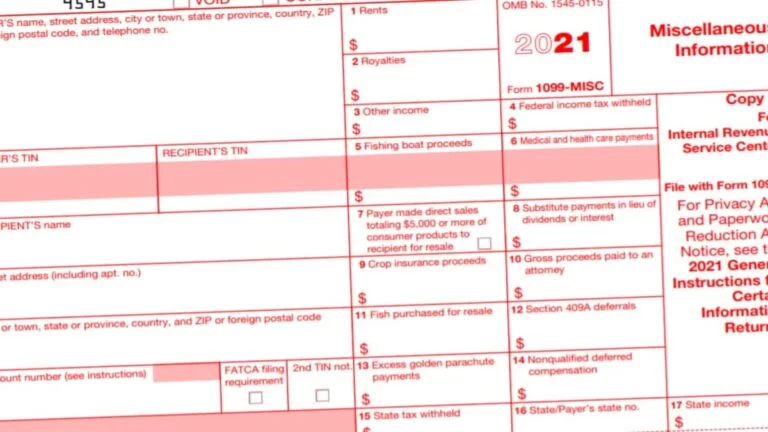

Payments received in error need to be reported to Aetna Provider Service Center – 88 prior to December 31 st to allow correction to 1099-Miscellaneous forms.Payments recorded under a TIN/TIN owner name are reportable to the IRS regardless of whether the payment has been processed by the recipient. A 1099-Miscellaneous form will not be issued and payments will not be reported to the IRS if total payments were less than $600 in a calendar year. Aetna is required to report to the IRS any payments of $600 or more to a TIN in a calendar year – January 1 through December 31.

of the 1099-Miscellaneous form will have the breakdown of which entity paid the TIN. Aetna mails 1099-Miscellaneous forms reporting all payments from Aetna and our blended entities to recipients prior to January 31 annually.

0 kommentar(er)

0 kommentar(er)